trust capital gains tax rate australia

Less any discount you are entitled to on your gains. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates.

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

You pay tax on your net capital gains.

. Companies with a turnover greater than 5000000000. Capital Gains Tax CGT is the tax you pay on capital. The income tax rates on income earned from assets in a testamentary trust are the same as personal income tax rates.

There is a capital gains tax CGT discount of. The trust deed defines income to include capital gains. Your Mortgage s Capital Gains Tax Calculator can help give you an estimate of the CGT you may have to pay when you sell your investment property.

Income tax rate. Broadly you calculate CGT on the difference between the asset sale price and the price paid. The income tax rate for companies is 30 except that companies that have less than AU 50 million of aggregated turnover which includes the.

The net income of a trust effectively its taxable income is its assessable income for the year less allowable deductions worked out on the assumption that the trustee is a. One of the tax advantages of a family trust is related to Capital Gains Tax CGT. However once the general 50 discount is deducted the taxpayer only declares 5000 capital gains income the tax on which at 37 is 1850.

What is the capital gains tax rate on a trust. The Income Tax Assessment Act 1936 ITAA 1936 ensures that a trustee is assessed on a non-resident trustee beneficiarys share of the net income of a trust. Click here for tax rates for 2010 2011 and 2012 for both Australian residents and non-residents.

Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. For example this may occur if the trustee. Creation of the trust deed.

As part of the trusts net income or net loss the trust has to. When setting up a family trust you can expect to pay between 1500 and 2500 GST. Companies with a turnover less.

A trustee derived the following amounts in the 201415 income year. A capital gain of 200 that is eligible for the CGT 50 discount. Less any capital losses.

At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed. Common Types Of Trusts Findlaw Matthew Ledvina Offers Us Tax Structuring Strategy Tax Return Us Tax Tax. Namely the 50 CGT discount.

If there is trust income to which no beneficiary is entitled then the trustee must pay tax on that income. Tax Paid by Trustees. The effective tax rate on the capital gain of 10000 is 185.

A trusts tax return is a data-matching tool for the Australian Taxation Office ATO. You report capital gains and capital losses in your income tax return and pay tax on your capital. The income of the trust estate is therefore 300 100 interest income 200 capital gain and the.

In most cases even though a CGT Event occurs you can. Capital gains tax CGT is the tax you pay on profits from selling assets such as property. If the trust disposes of all assets it is generally subject to capital gains tax CGT.

The tax on the capital gain would be 37. Your total capital gains. Trust capital gains tax rate australia Sunday May 29 2022 Edit.

Instead the capital gain you make is added to your assessable income in whatever year you sold the property. The ATO can cross-check the amounts distributed by the trust against the tax returns of. Capital Gain Tax Rate.

Will Wizard Australia Pty. Set up costs for a family trust. 2022 Long-Term Capital Gains Trust Tax Rates.

The Guide to capital gains tax 2022 explains how CGT works and will help you calculate your net capital gain or net capital loss for 202122 so you can meet your CGT obligations. Taxation of Capital Gains. This treatment is similar to the.

For this tool to work you. A capital gain or a capital loss will arise where a capital gains tax CGT event occurs or if another trust distributes a capital gain to you. Australia Corporation Capital Gains Tax Tables in 2022.

Even though it forms part of your income tax and is not.

2022 Trust Tax Rates And Exemptions Smartasset

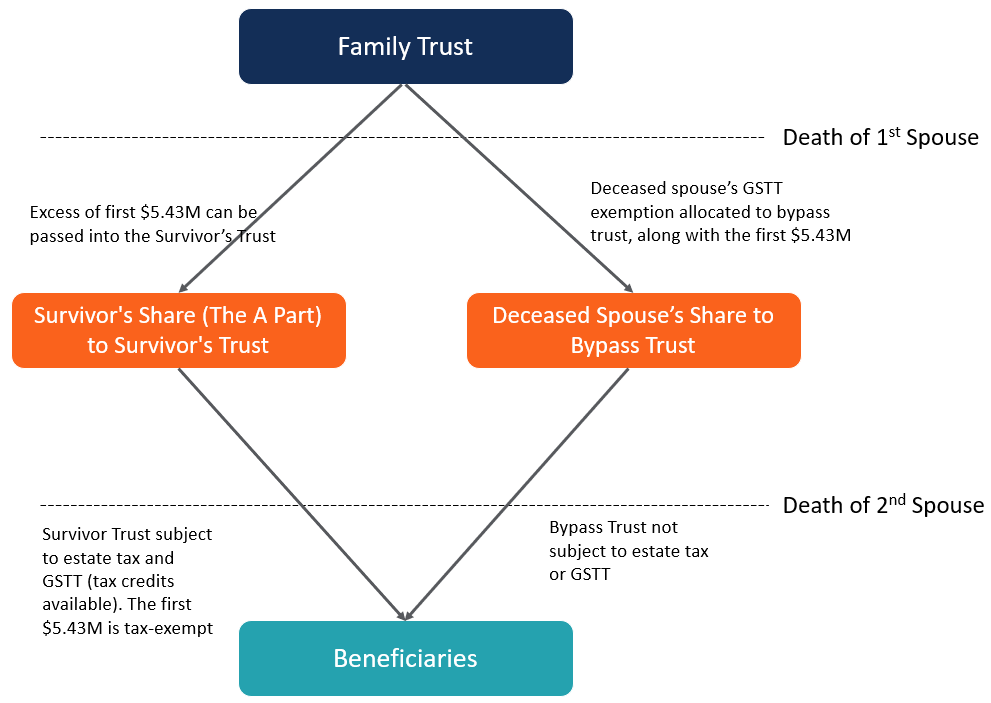

How To Avoid Estate Taxes With A Trust

How To Analyze Reits Real Estate Investment Trusts Real Estate Investment Trust Real Estate Investing Investing

How To Avoid Estate Taxes With A Trust

What Are The Tax Advantages Of A Trust Legalvision

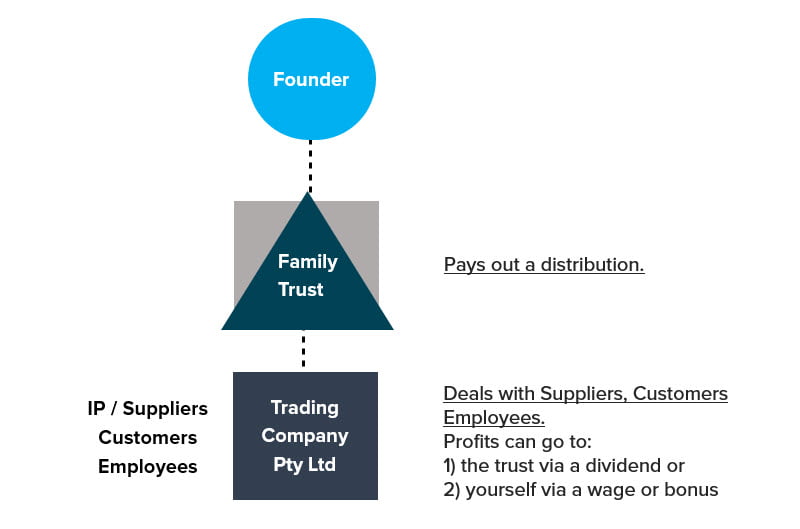

Including A Family Trust In Your Business Structure Fullstack Advisory

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

How Is A Family Trust Taxed In Australia Liston Newton Advisory

What Are The Tax Advantages Of A Trust Legalvision

Matthew Ledvina Offers Us Tax Structuring Strategy Tax Return Us Tax Tax

In Gold We Trust Why Bullion Is Still A Safe Haven In Times Of Crisis Gold Bullion Gold Money Buying Gold

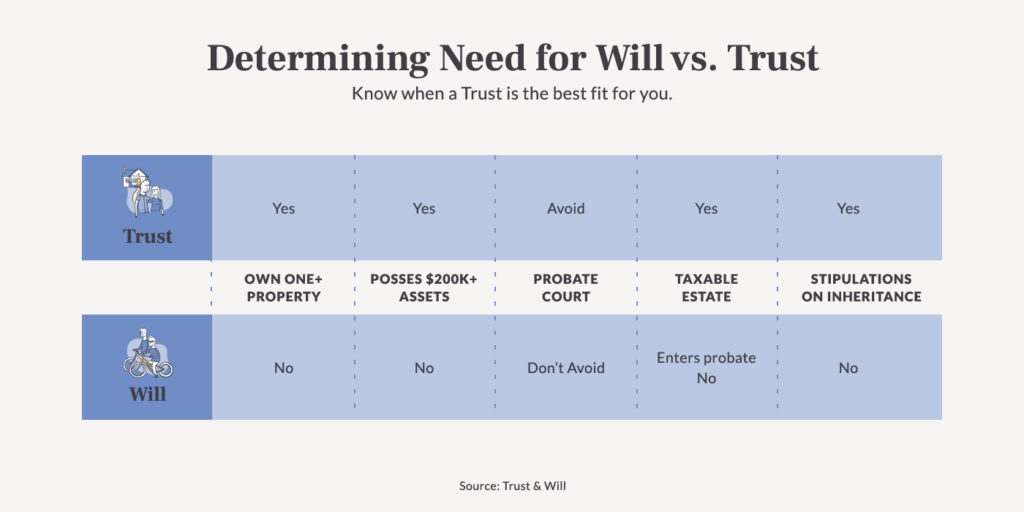

What Is A Trust In Estate Planning Trust Will

Health And Social Problems Are Worse In More Unequal Countries The Spirit Level Wilkinson Pickett Penguin 2009 Social Problem Math Literacy Social Class

Common Types Of Trusts Findlaw

Budget Basics Federal Trust Funds

How To Buy Cryptocurrency In Australia Buy Cryptocurrency Bitcoin How To Become Rich

How To Avoid Estate Taxes With A Trust